49 Trades:

1 AAL + 35 BPS.

48 UK100 + 234 BPS.

34 long trades + 237 BPS.15 short trades + 32 BPS.47 intra-day trades + 192 BPS.2 multi-day trades + 77 BPS.

Total trades net + 269 BPS.

Return on account for the week + 6.51 % net.

P:L ratio 25:1.

Days traded: 5.

Longest trade duration: 1 Day min.

Shortest trade duration: < 1 min.

(All PNL expressed in basis points for the purpose of comparison.)

Thoughts

Another volatile week on the equity market.

The markets were weaker early in the week, with the FTSE testing 6650 on Monday and then again on Wednesday, before dropping to 6618 on Thursday and then rallying on Friday. Crude oil was very weak on Thursday, which clobbered the commodity stock which are a large chunk of the FTSE.

Difficult trading conditions, so mostly very short term trades, but generally, the sharp dips were bought. I missed a few great trade entries, and sold closed the AAL position way too early.

Well over my 2.5 % benchmark.

I thought I'd post a chart here...

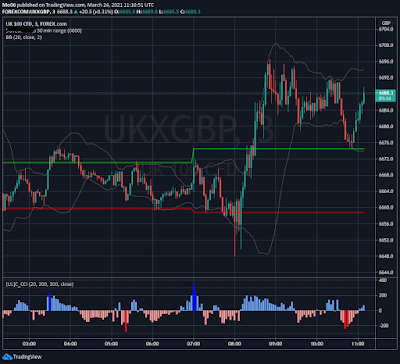

This is a five minute chart of the FTSE (Forex.com, not the cash) on Tradingview.com.

The red and green horizontal lines mark the high and low of the 30 minutes from 07:30 London time.

You can see how the FTSE dropped back after 10am, but found support at the early high marked by the green line.

I have noticed that these levels frequently form support or resistance later in the trading session.

A few years ago I wrote an indicator for MT4 which draws the levels, and recently I did the same in the Tradingview.com language, Pine, as shown on the top chart.

On strong trend days, the index will often test these levels before decisively break one of them, the trick is to catch the break and run with it.

I used to use 8 am as the start time, but I have found 7 to be better, if you watch the FTSE futures chart, the volume really kicks in at 7 am, I also have the same indicator set for 8 am as well (8 am is the cash open in London).

This is the same five minute chart in MT4, if the price is above the green line, the text changes to 'Upside break' and shows the distance of the break in basis points, same with the red line:

I would put the same text on the Tradingview indicator, but I haven't worked out how to do that at the moment.

The concept of the thirty minute levels is not mine, I got it from a book written by Jake Bernstein, several years ago now. I think there are a few videos on Youtube describing the strategy. It's very simple, but then some good ideas are simple.

Looking forward to more opportunities next week.

Stay disciplined.

Stay focussed.

Stay humble.