Saturday, December 29, 2012

Friday, December 28, 2012

Summary Week Ended Friday 28th Dec 2012

Just 2

stock trades:

1 BLT

+ 1.86 BPS

1 STAN

+ 12.15 BPS

Stocks

net + 14.01 BPS

All long trades, all intraday.

No

index trades.

Thoughts

A pretty

quiet week, LSE closed for 2.5 days dues to Christmas.

I traded 1 day.

Markets remained in narrow ranges on lowish volumes.

Stay

disciplined.

Friday, December 21, 2012

Summary Week Ended Friday 21st December 2012

7

stock trades:

3 AAL

+ 18.46 BPS

1 BG

+ 2.91 BPS

2 BLT

+ 15.41 BPS

1 STAN

+ 18.14 BPS

Stocks

net + 54.91 BPS

4 long trades, 3 shorts, all intraday.

No

index trades.

Thoughts

A pretty

quiet week.

I traded 3.5 days.

Markets remained in narrow ranges on lowish volumes. Next week is Xmas, so a shortened week for the LSE.

Stay

disciplined.

Stay

focussed.

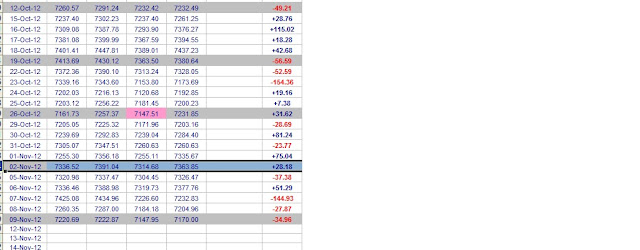

Trades by Category Q3 2012

Each trade is categorised as follows:

Time trade is opened:

I 0800 - 0900

A 0900 - 1200

L 1200 - 1500

F 1500 onwards

C: Countertrend (ie long when price is below a 1 day MA, opposite for shorts)

T: Trend (long when price is above the 1 day MA, opposite for shorts)

(The 'R' is for reversal, the 'B' for breakout, not really necessary.)

Friday, December 14, 2012

Summary Week Ended Friday 14th December 2012

7 stock

trades:

3 AAL

+ 13.97 BPS

2 BG

+ 29.43 BPS

2 BLT

+ 31.46 BPS

Stocks

net + 74.86

All

long trades, all intraday.

No

index trades.

Thoughts

A rather

quiet week, I traded 4 days. Markets remained

in narrow ranges. Tough trading conditions in general.

Still,

a small profit for the week. Well off my 500 BPS weekly target, but we have to take whatever the markets offer.

Stay disciplined.

Friday, December 07, 2012

Summary Week Ended Friday 7th December 2012

5 stock

trades:

2 BLT

+ 30.56 BPS

2 STAN

+ 17.20 BPS

1 XTA

+ 7.85 BPS

Stocks

net + 55.60

No

index trades.

Thoughts

A

lacklustre week, I traded 4 days.

Markets in narrow ranges, and the hoped for pull back on a weak non - farm payrolls report didn’t happen.

Markets in narrow ranges, and the hoped for pull back on a weak non - farm payrolls report didn’t happen.

Still,

a small profit for the week.

Stay disciplined.

Wednesday, December 05, 2012

Sunday, December 02, 2012

Summary Week Ended Friday 30th November 2012

12 stock

trades:

1 AAL

+ 9.11 BPS

7 BLT – 54.81 BPS

2 STAN + 5.63 BPS

2 XTA + 45.78 BPS

Stocks

net + 5.71

No

index trades.

Thoughts

A difficult week, I traded 4 days, poor trading on BLT resulted in giving back earlier gains, so the week ended up flat.

Better than a loss anyway.

Stay disciplined.

Stay

focussed.

Wednesday, November 28, 2012

Friday, November 23, 2012

Summary Week Ended Friday 23rd November 2012

4 stock

trades:

2 BARC

+ 94.40 BPS

1 BLT

+ 7.75 BPS

1 STAN

+ 2.78 BPS

Stocks

net + 104.93

No

index trades.

Thoughts

Traded

four days this week. A light volume week since Thursday was Thanksgiving in the

US.

Stay

disciplined.

Stay

focussed.

Tuesday, November 20, 2012

Friday, November 16, 2012

Summary Week Ended Friday 16th November 2012

10 stock

trades:

4 BLT

+ 44.61 BPS

1 STAN

+ 6.31 BPS

5 XTA

+ 58.86 BPS

Stocks

net + 109.78 BPS

Well short of my 500 BPS weekly target, but another positive week nevertheless.

No

index trades. I am concentrating on stock trades.

Thoughts

Traded

five days this week (four and a half as I was out Friday afternoon).

A

weak market, as the worries about the ‘Fiscal Cliff’ continue.

We are getting near to the traditional Santa rally though.

We are getting near to the traditional Santa rally though.

Stay

disciplined.

Stay

focussed.

Thursday, November 15, 2012

Wednesday, November 14, 2012

Tuesday, November 13, 2012

Sunday, November 11, 2012

Summary Week Ended Friday 9th November 2012

20 stock

trades:

5 BLT

+ 44.88 BPS

1 BP

+ 23.53 BPS

2 STAN

+ 27.25 BPS

1 XTA

+ 25.47 BPS

Stocks

net + 121.14

10

index trades:

12 Dax

– 124.90 BPS

6

FTSE – 49.15 BPS

Indices

net – 174.05 BPS

Thoughts

Traded

five days this week.

US election

result was followed by a big sell off on Thursday.

A

decent week on stocks, but a poor one on the indices.

I

have therefore dicided to concentrate 100% on stocks, since that is what I do

best, and actually I prefer.

Stay

disciplined.

Stay

focussed.

Friday, November 09, 2012

Sunday, November 04, 2012

THE DAY THE MARKETS BROKE

THE DAY THE

MARKETS BROKE

Tuesday morning at the trading desk – it is twelve

minutes to eight, and twelve minutes to the open.

“This is not looking good mate, not looking good at all …”

That's Mike, one of my team on the UK equities desk.

I have my eyes fixed on the Dax futures quotes, since the Dax opens for trade at seven am London time, and the market is selling off, hard.

71 04… 7100.. 7096..7092… the numbers are all red, and they keep on getting lower, on heavy volume.

The selling seems to be getting more intense as we approach the London market open.

I turn to look at Mike, who has his ‘phone to

his ear, and is staring at one of his screens.

“OK, here’s the plan – we wait for an early bounce before we sell the position.”

Mike nods, and speaks quietly into the ‘phone.

I turn to Jim, sitting at his desk to my

right.

“Jim, you hear that ? We wait before closing our position.”

“Whatever you say, boss.”

We have a bit of a problem. We are holding a rather large long position on a basket of bank stocks. And late last night, the news from the US markets wasn’t good – both Moodys and S&P had downgraded the financial sector, and of course, financial stocks in the US have sold off sharply.

This all happened after the London market closed at four thirty, so it looks like the slide will start as soon as the market opens at eight, in a little over ten minutes from now.

I pull up the position spreadsheet on one of my monitors. What a day to be long banks ! But then everything had looked OK at four thirty yesterday, in fact the position was already starting to show a small profit. Oh well, my job is to manage this as best as I can, and preserve capital.

Don’t try to be a hero !

“Two minutes chaps.”

It’s Jim.

All three of us sit at our desks now, watching

the screens and waiting for the prices to start moving.

First to speak is Mike.

“Bloody

hell, HSBC is getting clobbered…”

I glance at the quote, it says 572.50, having closed last night at 622. All the banks are already between six and ten percent down. On the position we are holding, that’s quite a chunk of cash.

“Yeah Mike, watching for some buying here, and on BARC too.”

I am looking at the level II screen, which shows the electronic order book on BARC. Now it was two minutes past eight, and there are a few buyers appearing on the stock.

I click on the ask price and am immediately filled at 1.72. Now we have an even bigger position on BARC. My plan is to sell the lot on the first bounce. I scribble the entry price, time and size on my desk blotter in front of me..

“Jim, if you see any buying on HSBC, then you know what to do.”

“Sure Chief.”

“OK chaps, lets focus.”

I contine to watch the BARC orders hit the book, it is now trading just above the lows, at 1.74, and I think it looks ready to break above 1.75. I buy some at 1.76, get filled instantly and write the numbers down on the blotter.

Thirty seconds later and BARC is trading at

1.825, I close out the entire position.

“BARC all gone chaps.”

There is no time to calculate the total damage, we still have a lot of stock on the book and I think prices will break the lows, given how far the US futures have fallen overnight.

Wednesday, October 31, 2012

Summary Week Ended Friday 2nd November 2012

20 Trades:

1 ANTO +

2.32 BPS

1 BARC +

17.50 BPS

13 BG – 16.17

BPS

3 BLT + 25.33

BPS

1 BP +

302.40 BPS

1 FTSE

+ 1.19 BPS

NET +

332.21 BPS

Thoughts

Traded

five days this week.

US

markets were closed on Monday & Tuesday due to hurricane Sandy, NYSE

reopened on Wednesday

Huge

volatility on BG after results.

A decent week, although I gave some profit back trading BG too much. Best profit was a long on BP which I held overnight as it hadn't hit my stop and closed at 0822 after results came out strong.

I need to concentrate on the stocks which pay best and I have deleted LLOY from the stock list as the spread is too wide for intraday trading.

Stay

disciplined.

Stay

focussed.

Tuesday, October 30, 2012

Friday, October 26, 2012

Summary Week Ended Friday 26th October 2012

Trades

1 AAL

+ 15.93 BPS

8 BLT

+ 26.08 BPS

3 BP -76.12

BPS

4 XTA

-30.95 BPS

5

FTSE + 9.99 BPS

NET –

55.07 BPS

All

intraday trades.

Thoughts

Traded

three five days this week.

I am

trading stocks again, using Cap Spreads (since CMC reintroduced min

commissions).

Stay

disciplined.

Stay

focussed.

Saturday, October 20, 2012

Summary Week Ended Friday 19th October 2012

Summary Week Ended Friday 19th October 2012

Trades

2 AAL

+ 25.86 BPS

2 BARC

– 45.58 BPS

2 BLT

+ 27.06 BPS

1 BP +

2.24 BPS

1

HSBA – 27.77 BPS

1 XTA

+ 3 BPB

NET –

15.20 BPS

All

intraday trades.

Thoughts

Traded

three five days this week. Tight rangebound market for most of the week. A difficult week all in all.

Change on the week:

FTSE + 102.83

Dax +148.15

I am

trading stocks again, using Cap Spreads (since CMC reintroduced min

commissions).

Stay

disciplined.

Subscribe to:

Posts (Atom)