Sunday, June 29, 2014

Wednesday, June 25, 2014

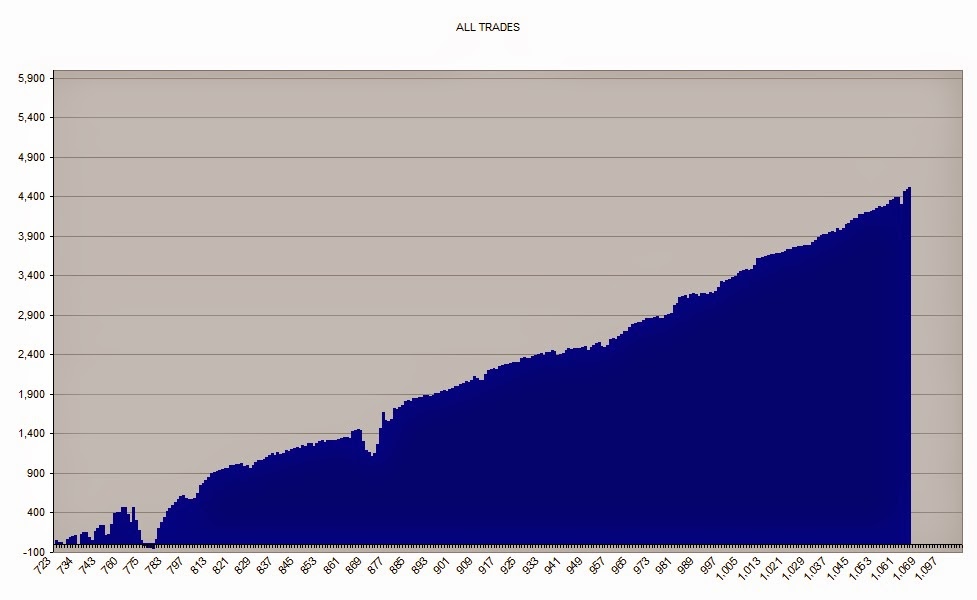

Summary Week Ended Friday 27th June 2014

26 Stock Trades:

2 AAL + 69.43 BPS

9 BARC + 315.22 BPS

5 BLT + 75.46 BPS

2 BP + 31.71 BPS

4 SBRY + 90.95 BPS

4 STAN + 74.15 BPS

Stocks net + 656.92 BPS

22 long, 4 short trades, intraday and overnight.

I traded 4.5 days this week.

Return on account for the week + 11.04 % net.

P:L ratio 8.63:1.

No Index trades, I am concentrating on stocks.

Thoughts

Another fairly volatile week, which I like to see. I was pretty busy, I even traded my old friend BP for the first time for months.

A decent return, well north of my 2.5% weekly benchmark. Would be nice to acheive this every week, but rather unlikely I think.

The benchmark has been exceeded for all four weeks of June (so far), which is good. The equity market has been a very friendly place recently, but I have no idea how long this will continue. July is normally a quieter month, I believe some people take holidays at this time of year.

We saw a bit of a sell - off on Wednesday after the US dropped.

BARC and STAN were down sharply on Thursday on news. I caught some of the move, but some exits were poor.

These charts of BLT show how the 1st 30m high/lows (Red and green dotted lines on the chart) often act as support or resistance. I watch these levels closely during the rest of the trading session.

Looking forward to more opportunities next week. I'm up a decent percentage on the month, and I will be cautious in what remains of June (one day...).

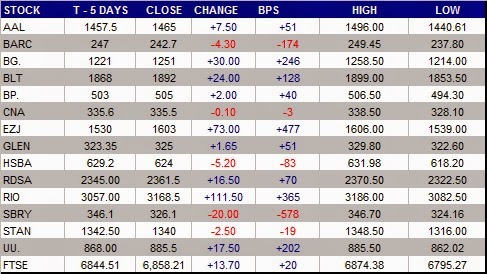

Changes on the week:

Stay disciplined.

Stay focussed.

Stay humble.

Thursday, June 19, 2014

Summary Week Ended Friday 20th June 2014

17 Stock Trades:

3 AAL + 94.94 BPS

3 BLT + 25.09 BPS

6 SBRY + 96.59 BPS

5 STAN + 106.66 BPS

Stocks net + 323.28 BPS

All long trades, all intraday.

I traded 5 days this week.

Return on account for the week + 4.87 % net.

P:L ratio was 13.1:1 - I had one losing trade....

No Index trades, I am concentrating on stocks.

Thoughts

Another fairly volatile week, which I like to see.

A decent return, well above my 2.5% weekly benchmark.

A couple of poor exits, and a few missed opportunities. Frustrating that I practically caught the lows of the week on BLT on Tuesday in the low 1830s, but didn't ride it into the highs on Thursday. Same on AAL.

I guess I didn't fancy the risk of a gap down overnight. Of course, both AAL and BLT gapped up on Thursday morning after the FOMC.

BLT high back on 9th June was 1918, then on Thursday (the 19th) it peaked at 1917.5 before falling below 1900... who says price doesn't have memory ?

STAN was weak, making a new 30 day low on Friday. BARC remained weak too.

BP and RDSA/B made new 52 week highs.

Changes on the week:

Although the Fed continues to swamp the financial markets with cash, I remain cautious on the equity markets for now. Not sure how this is all going to end, but it will probably surprise a lot of market participants.

Friday lunchtime here and I think I'm done for the week.

Looking forward to more opportunities next week. I'm up a decent percentage on the month, and I will be cautious in what remains of June.

Besides, lots of quality football to be enjoyed....

Stay disciplined.

Stay focussed.

Stay humble.

Friday, June 13, 2014

Summary Week Ended Friday 13th June 2014

20 Stock Trades:

6 AAL + 77.71 BPS

5 BLT + 37.74 BPS

3 EZJ + 144.43 BPS

1 SBRY + 5.54 BPS

5 STAN + 34.23 BPS

Stocks net + 299.65 BPS

All long trades, intraday and overnight.

I traded 5 days this week.

Return on account for the week + 3.40 % net.

P:L ratio N/A as there were no losing trades.

No Index trades, I am concentrating on stocks.

Thoughts

Another fairly volatile week, which I like to see. Volatility picked up on Thursday and Friday, after a quiet start to the week.

Over my 2.5% weekly benchmark again this week.

Miners were volatile on thursday, with AAL and BLT gapping down - see chart.

Both AAL, BLT and RIO made 30 day lows this week.

Most of my watch list stocks finished the week lower

BP made a new 52 week high on Friday, crude was also strong following the events in Iraq.

A couple of poor exits, and a few missed opportunities. That's trading.

I remain cautious on the equity markets for now.

Looking forward to more opportunities next week.

Stay disciplined.

Stay focussed.

Stay humble.

Saturday, June 07, 2014

Friday, June 06, 2014

Summary Week Ended Friday 6th June 2014

12 Stock Trades:

4 AAL + 81.36 BPS

3 BARC + 78.53 BPS

3 EZJ + 91.51 BPS

1 SBRY + 22.99 BPS

1 STAN + 4.53 BPS

Stocks net + 278.92 BPS

11 long and 1 short trade, intraday and overnight.

I traded 4 days this week.

Return on account for the week + 2.90 % net.

P:L ratio was N/A as there were no losing trades.

No Index trades, I am concentrating on stocks.

Thoughts

A volatile week, which I like to see.

Above my 2.5% weekly benchmark, which is good.

Most of my watch list stocks finished the week higher:

A few missed opportunities this week.

Looking forward to more opportunities next week.

Stay disciplined.

Stay focussed.

Stay humble.

Subscribe to:

Posts (Atom)