Saturday, May 31, 2014

Friday, May 30, 2014

Summary Week Ended Friday 30th May 2014

11 Stock Trades:

6 AAL + 16.80 BPS

2 BARC + 6.53 BPS

2 BLT + 10.10 BPS

1 SBRY + 10.85 BPS

Stocks net + 44.28 BPS

All long trades, intraday and overnight.

I traded 4 days this week.

Return on account for the week + 0.42 % net.

P:L ratio was 1.39:1.

No Index trades, I am concentrating on stocks.

Thoughts

A short week due to the bank holiday on Monday.

Very difficult to find decent trades and I struggled to make a decent return this week.

Well short of my 2.5% weekly benchmark.

I missed a lovely rally on SBRY, despite buying near the low of the week. - BE PATIENT !!

Over the month of May, I made 44 trades, net + 675 BPS and return on my account of just over 16%.

My P:L ratio was 5.2:1.

I'm sure there are lots of traders out there making over 20% per month, but it's better than a savings account.

The breakdown of the trades in May was as follows:

12 AAL

15 BARC

13 BLT

2 EZJ

This week the ES finally broke through 1900, and the Dax may want to test 10,000 soon.

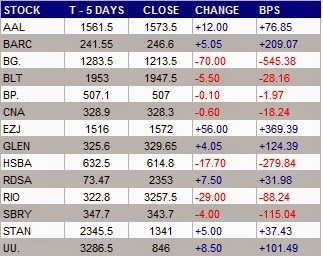

Changes on stocks I watch over the month:

The fall on the miners can be seen in the moves on RIO, AAL, and BLT, although GLEN actually rose over the period. UU has been very strong.

The miners sold off at the end of the week, the mining index falling over 3.4% on Friday. Gold fell below the $1250 level.

Looking forward to more opportunities next month.

Stay disciplined.

Stay focussed.

Stay humble.

Friday, May 23, 2014

Summary Week Ended Friday 23rd May 2014

5 Stock Trades:

3 BARC + 163.20 BPS

2 EZJ + 75.04 BPS

Stocks net + 238.34 BPS

All long trades, overnight.

I traded 5 days this week.

Return on account for the week + 2.76 % net.

P:L ratio was N/A as there were no losing trades.

No Index trades, I am concentrating on stocks.

Thoughts

A decent week. A profit is a profit, although my entries were not at the best levels.

And I missed some good entries on the miners on Thursday & Friday.

Again above my 2.5% weekly benchmark, which is good.

Here are the changes on my watch list stocks for the week:

Next week is a short one since Monday is a holiday in the UK.

The ES is threatening to break 1900 at the moment.

Looking forward to more opportunities next week.

Stay disciplined.

Stay focussed.

Stay humble.

Monday, May 19, 2014

Friday, May 16, 2014

Summary Week Ended Friday 16th May 2014

11 Stock Trades:

1 AAL + 8.55 BPS

3 BARC + 21.19 BPS

7 BLT + 69.28 BPS

Stocks net + 99.02 BPS

4 long, 7 short trades, all intraday.

I traded 5 days this week.

Return on account for the week + 2.69 % net.

P:L ratio was 4.8:1.

No Index trades, I am concentrating on stocks.

Thoughts

A decent week. Again, a few poor exits, but a profit is a profit.

Again above my 2% weekly benchmark, which is good.

After some analysis, I have decided to increase this benchmark/target to 2.5%, so I just scraped in above that this week, even though it was a pretty quiet week overall.

Trading on BLT was interesting this week, it rallied strongly from the 1890s to 1980s, and I had a look at the price history:

There was a high of 1989 in Feb, shown in blue. One thing I never really understand is who is buying near obvious resistance ? Shorts covering their losses perhaps ?

Note how far it fell after that high on the 21st Feb ?

Anyway, this was an obvious short level. Unfortunately, I got nervous when the price didn't immediately drop back to the 1960s, and closed for a small profit (always more nervous short than long). Of course, it later dropped back to the 1960s. But that's trading for you.

I still don't understand why people were buyers at 1985..... Were they also sellers in the 1890s last Friday I wonder... Oh well...

Later in the week, BLT did manage to break out and hit the 2000 mark, although it closed at 1995. I took the opportunity to sell some shares at 2000 that I bought back in Decemeber 2013 at 1763

Once the dividend of around 35p is included, this is a gross return of 15.4% on this investment (trade ?), or 1540 BPS.

This is obviously not included in the account being monitored in this blog, but a decent return on a boring large cap stock. It would be nice to do one of those every month.

We saw some serious weakness on stocks during Thursday and Friday, although the FTSE actually managed to close positively on Friday .

Change on watch list stocks over the last 5 Days:

| STOCK | T - 5 DAYS | CLOSE | CHANGE | BPS |

| AAL | 1604 | 1561.5 | -42.50 | -264.96 |

| BARC | 260.15 | 241.55 | -18.60 | -714.97 |

| BG. | 1264.5 | 1283.5 | +19.00 | +150.26 |

| BLT | 1896.5 | 1953 | +56.50 | +297.92 |

| BP. | 500.9 | 507.1 | +6.20 | +123.78 |

| CNA | 318.5 | 328.9 | +10.40 | +326.53 |

| EZJ | 1685 | 1516 | -169.00 | -1,002.97 |

| GLEN | 325.5 | 325.6 | +0.10 | +3.07 |

| HSBA | 596 | 632.5 | +36.50 | +612.42 |

| RDSA | 76.37 | 2345.5 | -24.50 | -103.38 |

| RIO | 325.2 | 3286.5 | +98.00 | +307.35 |

| SBRY | 335.8 | 347.7 | +11.90 | +354.38 |

| STAN | 2370 | 1336 | +44.00 | +340.56 |

| UU. | 3188.5 | 837.5 | +15.00 | +182.37 |

Looking forward to more opportunities next week.

Stay disciplined.

Stay focussed.

Stay humble.

Wednesday, May 14, 2014

Watch List Stocks 5 Day Change at Close 13th May 2014

Five day change on my watch list stocks at yesterday's close:

| STOCK | T - 5 DAYS | CLOSE | CHANGE | BPS | ||||

| AAL | 1542.5 | 1637.5 | +95.00 | +615 | ||||

| BARC | 245 | 255.35 | +10.35 | +422 | ||||

| BG. | 1266 | 1269 | +3.00 | +23 | ||||

| BLT | 1912 | 1965 | +53.00 | +277 | ||||

| BP. | 501 | 500.2 | -0.80 | -16 | ||||

| CNA | 324.2 | 323.6 | -0.60 | -18 | ||||

| EZJ | 1667 | 1658 | -9.00 | -54 | ||||

| GLEN | 320.75 | 330.65 | +9.90 | +309 | ||||

| HSBA | 604.1 | 611 | +6.90 | +114 | ||||

| RDSA | 78.5 | 2370 | +23.50 | +100 | ||||

| RIO | 325.2 | 3330.5 | +115.50 | +359 | ||||

| SBRY | 333.4 | 339 | +5.60 | +168 | ||||

| STAN | 2346.5 | 1308 | +27.50 | +215 | ||||

| UU. | 3215 | 834.5 | +30.50 | +379 |

Saturday, May 10, 2014

Daily Stocks Spreadsheet Week Ending 9th May 2014

We had a decent week in terms of volatility.

I will be watching AAL next week, recent top was 1605.5 so just broken, and yesterday was the first close above 1600 since September 2013.

I have replaced RIO on the spreadsheet with SBRY.

Thursday, May 08, 2014

Summary Week Ended Friday 9th May 2014

15 Stock Trades:

3 AAL + 33.95 BPS

7 BARC + 156.51 BPS

4 BLT + 41.88 BPS

1 SBRY + 30.52 BPS

Stocks net + 262.87 BPS

5 long, 10 short trades, overnight and intraday.

I traded 3 days this week.

Return on account for the week + 6.75 % net.

P:L ratio was 4.35:1.

No Index trades, I am concentrating on stocks.

Thoughts

A decent week. A few poor exits, but a profit is a profit.

Again well above my 2% weekly benchmark, which is encouraging.

Markets were closed on Monday for the spring bank holiday.

BARC was very active after results came out on Tuesday (see chart), and I could have made a fair bit more on it if I had held my long overnight, but that's trading.

This week I added SBRY to my watchlist spreadsheet, a stock I used to trade in the past. SBRY has had some decent moves recently.

Looking at my spreadsheet, I note that I haven't had a losing week on my stock trading since early October 2013, so I realise that I need to excercise caution at the moment...

Going to post this now (Friday) since I think I am done for the week.

Looking forward to more opportunities next week.

Stay disciplined.

Stay focussed.

Stay humble.

Thursday, May 01, 2014

Summary Week Ended Friday 2nd May 2014

12 Stock Trades:

3 AAL + 49.36 BPS

7 BLT + 34.82

2 RDSA + 2.96 BPS

Stocks net + 87.14 BPS

Long and short trades, all intraday.

I traded 5 days this week.

Return on account for the week 2.36 % net.

P:L ratio was 3.19:1.

No Index trades, I am concentrating on stocks.

Thoughts

A pretty quiet week. A few poor entries, but a profit is a profit.

North of my 2% benchmark, which is good.

Over the month of April, my trades were as follows:

18 AAL + 213.94 BPS

38 BLT + 354.78 BPS

5 EZJ + 89.87 BPS

2 RDSA + 2.96 BPS

3 STAN + 35.35 BPS

TOTAL 66 trades + 696.89 BPS

Return on account for April +12.50 % net.

P:L ratio was 4.26:1.

I am pretty pleased with the percentage return, although it could have been better.

Interestingly, 65 of the 66 trades were intraday trades.

Looking forward to more opportunities next week.

Stay disciplined.

Stay focussed.

Stay humble.

Subscribe to:

Posts (Atom)