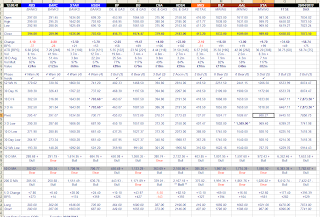

9 stock trades:

3 BARC + 309.9 BPS

5 BLT + 37.52 BPS

1 RDSA + 3.88 BPS

Stocks net + 351.3 BPS

No losing trades this week.

Long and short trades, intraday and overnight.

No Index trades.

I traded 3 days this week.

Thoughts

Another shortened week, the technicians (yes two of them....) from Orange were back to fix my broadband

connection on Monday, and it seems to be OK now (connected continuously for over 50 hours).

Tomorrow is Friday (and expiry) and I am going away for the weekend very early, so posting this on Thursday.

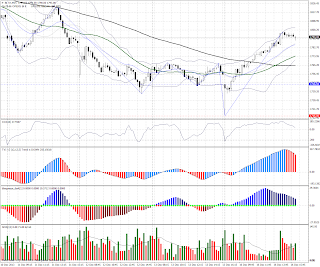

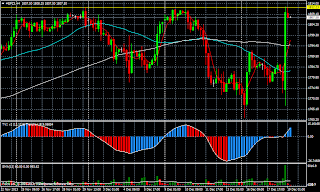

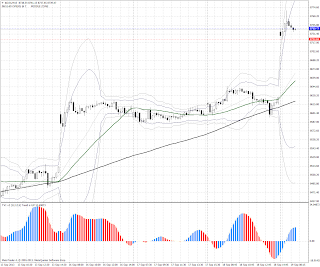

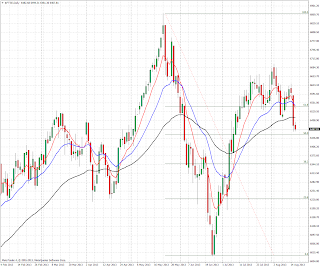

A better week, the markets went a bit crazy after the US Federal Reserve announced that there would be no tapering at the moment, due to the state of the US economy.

Another week on the positive side. I need more like that. Now I'm focussing 100% on stocks, I feel more relaxed about my trading.

I am also being MUCH more selective in my trading, often sitting for hours without entering the market if nothing hits the levels I am looking for.

I have also decided not to enter the market during certain periods of the day, after analysis of my trading records showed that these periods had a negative effect on my P&L.

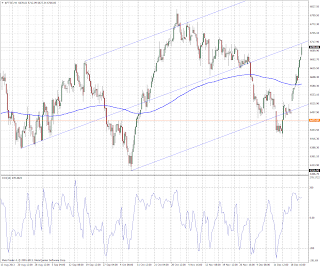

Dax chart showing Thursday's reaction to the Fed (A new all time high on the Dax):

Stay disciplined.

Stay focussed.