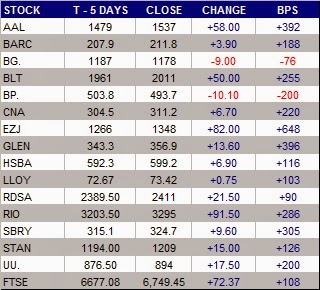

22 Stock Trades:

16 AAL + 251.58 BPS

4 BARC + 79.68 BPS

1 BLT + 2.44 BPS

1 BP + 3.05 BPS

Stocks net + 336.75 BPS

12 long trades: + 213.25 BPS.

10 short trades: + 123.50 BPS.

21 intraday trades, 1 overnight trade.

I traded 5 days this week.

Return on account for the week + 4.42 % net.

P:L ratio was 24.9:1.

No Index trades.

Thoughts

A busy week.

I shorted AAL a tad early, I was long BARC and again my exits were pretty poor, and closed a long trade on BP criminally early, but that's the trading business.

This week I was reminded of a golden rule regarding trading:

"It's all about exits !!"

With this volatility, it's so easy to let a profit turn into a loss.

North of my 2.5% benchmark, which is good.

Overall, markets were strong this week. Miners were bid up, with BLT and GLEN made new 52 week highs. Oils were weaker, with BP making a 30 day low on Monday, before rebounding sharply.

AAL was volatile, so far this month I have scalped 685 BPS on it, and so far this year AAL has netted me a tad over 2000 BPS.

AAL is a good trading stock, plenty of volatility and decent liquidity as well.

I feel the need for a break from the markets, and therefore I may take some time off in the next few weeks.

Stay disciplined.

Stay focussed.

Stay humble.